This week is the first part of a 3-part topic focussed on developing a Cost of Sales Budget for the next financial year.

Last week concluded with the creation of your business’ ‘final draft’ Sales Budget. Now the objective is to determine the Cost of Sales budget for these sales, starting with Materials. If you are a services business, the information that follows won’t be relevant to you. Tune into next week’s blog for more appropriate information for you if you don’t deal in products.

The Material component of Cost of Sales includes both ‘Bills of Materials’ or ‘Recipe’ for your manufactured product, as well as the Cost of Sales for Product Purchased for Resale by a distribution entity.

The first step is to determine your budgeted raw material unit costs and budgeted purchase product unit costs from your suppliers for the next financial year. Try to lock in pricing from your suppliers for the next year or at least give indicative pricing, as well as an inflation allowance for this purpose.

If you are importing raw materials and/or finished goods, you will need to make some assumptions about exchange rates. Speak to your business banker and ask if they can provide you with the banks forecast exchange rates. Use these to calculate your import purchase unit costs, including duty and shipping if applicable, back into Australian dollars.

MANUFACTURER – IF YOU HAVE BILLS OF MATERIALS OR RECIPE

If you have Bills of Materials or Recipes for your manufactured product, you will have material requirements to make a unit of each product. Multiplying the material requirements for a unit of product by the budget raw material costs will give you budget material cost per unit by each finished item. Don’t forget to include scrap allowance or waste allowance.

Multiplying your budgeted sales volumes and your budget material cost per unit will give you your first look materials budget. Hopefully you can break down the material budget by your sales categories.

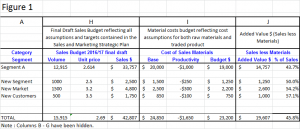

Using the Sales budget spreadsheet example that we have used in previous blogs, add in three more columns (see Figure 1, Column I below). The first column is your base materials budget as has just been determined.

Refer to your Strategic Plan; did you come up with some productivity improvement targets or actions around your material costs? Maybe you are changing suppliers, or reducing scrap rates due to Six Sigma/lean initiatives? Maybe you are changing you recipes/bills of materials to substitute a different material mix? There should be some continuous improvement targets for materials and these should be reflected in your budget. Refer to the second column within Column I for examples.

MANUFACTURER – IF YOU DON’T HAVE BILLS OF MATERIALS OR RECIPES OR YOU ARE A START-UP

If you don’t have the ‘Bills of Materials’ (BoM’s) or Recipes at a manufactured product level, you can always use a listing of your material purchases year to date and adjust those values for changes in your volumes and factor in price changes at a macro level. You would still want to reflect productivity initiatives that have come out of your strategic planning process and hopefully you can at least arbitrarily attach the budget costs to Sales categories; see figure 1 column I below for an example.

If you are a start-up manufacturer, hopefully you will have researched your material requirements and recipes and determined the type and quantity of materials you will need. From your research, you should have some indicative prices from suppliers and therefore be able to estimate a rough materials budget.

DISTRIBUTOR/RESELLER

If you are an import/distributor or reseller you will need to come up with budget product purchases reflecting your sales budget. The process for setting unit costs for the coming year is simpler than for a manufacturer but the logic is still the same. By multiplying your budgeted sales volumes by your Purchase product budgeted unit costs, plus any duty or freight etc that may be applicable. you will have your first look materials budget. Try to break down the material budget by your sales categories.

The third column of Column I in Figure 1 below is the sum of base material costs less productivity material improvements.

Sales less material gives you the metric known as Added Value. Add a further column to your spreadsheet to reflect Added Value $ and % (Refer Figure 1, Column J).

Use this week to develop the first component of your Cost of Sales budget; your Materials Budget for the next financial year to provide a sound foundation for business success.

As always, if you need some help or guidance, don’t hesitate to call me on (03) 9554-3128.

Next week we move to our second part of Cost of Sales budget, direct labour.

Ross