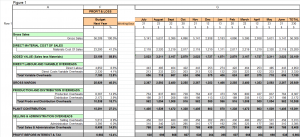

Last week, you finalised phasing your Profit and Loss (P&L) budget for the next financial year.

This week, we will look at another key budget document: your budget balance sheet. This is an important component of your budget because it will drive one of your key strategic objectives as noted in Blog 7: Cash!

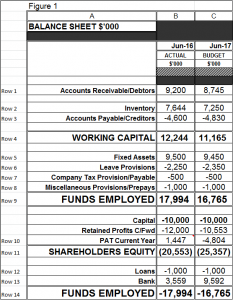

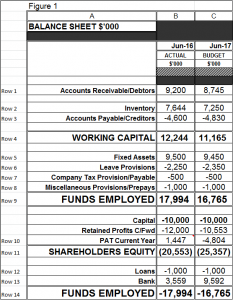

Refer Figure 1 below as an example of a simple fictitious Balance Sheet where Column A represents broad categories of your Balance Sheet, Column B is your current actual balance sheet values and Column C is your budget balance sheet for the forth coming financial year.

Working through each of the key balance sheet items in turn with your current actual balance sheet and ratios as a starting point:-

- Accounts Receivable/Debtors – refer Row 1 below – you should budget an improvement in your debtors days outstanding of at least 50% and hopefully it sits below 60days.

- Inventory – refer Row 2 below – as with the Accounts Receivable, you should budget an improvement in your inventory days held of at least 5% and hopefully it is below 90days.

- Accounts Payable/Creditors – refer Row 3 below – the goal is to increase the number of days; which is opposite pattern to Debtors/Inventory. It should mirror the Debtors days as a target but for budgeting purposes let’s assume you increase payable days by 5% for your budget.

As an illustration, if your Working Capital (Debtors plus Inventory less Creditors) is $100k and you improve each of Debtors, Inventory and Creditors by 5%, that equates to an extra $5k in cash to your business.

- Fixed Assets – refer Row 5 below starting with from your closing down written value of Fixed Assets, add your additions and subtract your disposals and subtract your depreciation expense to calculate a budget Fixed Assets values.

- Leave provisions (Annual Leave and Long Service Leave) – refer Row 6 below. Using your closing actual leave provision values and assuming that the budget is for all employees to take their 4 weeks Annual Leave, the Budget Annual Leave provision will only increase by pay rate increases. Long Service Leave is a little more difficult as the entitlement and taking of long service leave needs more detailed analysis, sometimes at an individual level.

- Company Tax Payable/GST – refer Row 7 below. These amounts payable to the government should be estimated for budget purposes.

- Miscellaneous Provisions/Prepayments – budgeting for these general accruals and prepayments should be fairly straight forward, use closing values as a guide to calculate these.

Summing up all of the above gives you your Funds Employed values for both actual and your budget. Refer Row 9 below. Funds employed gives you the value your net assets excluding bank/loans, of the business. The way these net assets have been funded through shareholders equity, loans and bank balances is totalled up at Row 14 below. Note that as a Balance Sheet principle, it needs to balance whereby row 9 is to equal row 14.

The Shareholders Equity section of your Balance Sheet is where your accumulated profits and capital amounts reside. Your P&L Budget Profit After Tax will transfer into this section Refer Row 10.

The ‘magic’ number/s that drops out to balance your budget balance sheet are your loan/bank balance (Rows 12 and 13 below). This will give you the picture of where the financing of your business is projected to be based on your P&L Budget and the components of your budgeted Balance Sheet.

The question/s might be, do you need to organise additional funding? Will you have excess funds available for investment? Do you need to review your capital expenditure?

SUMMARY

Use this week to develop your budget Balance Sheet and hence identify Bank/Funding requirements as part of your budget process.

As always, if you need some help or guidance, don’t hesitate to call me on (03) 9554-3128.

Ross – Virtual CFO