This is the third part of a four-part series looking at the first quarter results of the 2016/17 financial year. Previously, we have looked at the Profit and Loss and the Balance Sheet Reports. This week we look at the Cashflow Statement and undertake a quarterly review of your actual Q1 results compared to the budget and prior year.

Your Accountant or CFO or Virtual/Part-Time CFO should be providing you with your management reports and analysis within a week following month-end in a concise but comprehensive slide deck of six or seven slides/pages. The Cashflow Statement will be one of the slides in the slide deck, which should be presented and discussed at your management review meeting.

In relation to the last two newsletters, it is interesting, but not surprising, to note that the Profit and Loss Statement newsletter received 30% more ‘reads’ then the Balance Sheet newsletter. The pre-occupation with profit is understandable, but Balance Sheet management is just as important as Profit and Loss achievement.

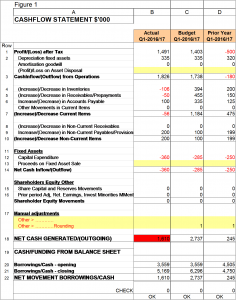

CASHFLOW STATEMENT

I suspect that this newsletter with get less ‘reads’ than the Balance Sheet newsletter, but it really is a key part of this trio of management reports. The Cashflow Statement pulls the Profit and Loss Report plus the Balance Sheet report together to show how the movement in cash balances has occurred during the quarter.

Cash of course is the key number for SME’s, without it, your business will certainly fail, hence the importance of the Cashflow statement cannot be understated.

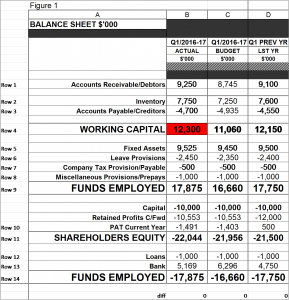

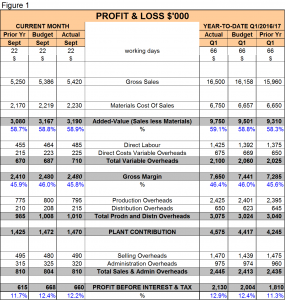

Back in Newsletter 20, you created your Budget Cashflow Statement. Using that same format, below is an example of a Cashflow Statement slide showing actual values/movements for the Q1/2016-17 (Column B), Budget for Q1 (Column C) and then the prior year Q1 actual values (Column C); refer Figure 1 below. Graphs and charts can also be used for illustration purposes.

Each variation exception should be reviewed by your Accountant or CFO in the first instance comparing budget and prior year figures and flagging variances/issues. TIP: I use a colour code system of RED (PROBLEM), ORANGE (WARNING) and GREEN (GREAT) as an effective flag for exceptions (refer Figure 1).

By understanding the assumptions on which the budget Profit and Loss and Balance Sheet numbers have been derived, you should be able to understand why your actual Bank Balance figure vary to the budget. At a macro level, in the example I have used over the last two newsletters, we achieved higher than budget profit, and yet our cash balances are well short of budget. The reason for this is we are carrying excess inventories, our Accounts Receivables balances are higher than budget and we are spending in capital faster than budget. Refer Figure 1 below. Actions should be taken to address these issues clearly.

SUMMARY

Use this week to understand and analyse your Cashflow Statement for Q1 as it is the lifeblood of your business and provides a sound foundation for business success.

NEXT WEEK

Next week will move to the fourth Q1 report, Forecast Report.

WE HAVE MOVED

We have recently moved from our Dandenong South location to be more central to our client’s locations. You will now find us at Ground Floor, 203-205 Blackburn Road, Mount Waverley, VIC, 3149. Our new phone number is (03) 9847-6834. As always, if you need any help or want a no obligation chat, don’t hesitate to contact us.

Ross – Billson Advisory