When you start planning to start your own business, you should be also planning how you will exit that business. Starting your own business is perhaps your biggest financial investment, along with your home, and you will want to ensure that the return on this investment is maximised. Will you sell your business through a business broker when the time is right? Will you plan to hand the business onto your children? Will you have a successor ready to take over when you are ready to exit? Or will you simply close the doors and leave it all behind? The ironic thing is that recent surveys indicate that less than half of surveyed SME owners have a succession or exit plan in place.

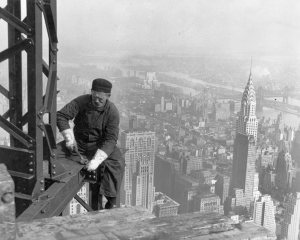

Your exit strategy is a key issue because you want to maximise the value of your business and get the timing right and make sure you don’t have to delay your retirement. An interesting statistic is that the average age of a SME owner is 56! Our ageing population means more and more businesses will come up for sale meaning by pure supply-demand economics, business sale prices will fall. This is particularly relevant as more baby boomers head towards retirement and are looking to exit their businesses.

Before exiting your business, you need to document processes and formalise customer, supplier and employee relationships and ensure that the business is not dependent on you for it to succeed. The business’ profits need to be sustainable in a potential purchasers eyes. Nobody will be interested in buying or running a business which collapses following your exit if you are in reality the business.

It is generally accepted that it takes 3 to 5 years to have a business ‘sale ready’ so don’t delay developing your exit strategy. You want to be ready in case an unexpected offer to buy your business materialises.

Due Diligence

Any potential purchaser of your business will undertake a due diligence process which will cover all aspects of your business to ensure it is legitimate and sustainable and that the numbers presented stand scrutiny. From that due diligence process, a potential buyer will put a value on the business most likely a profit multiple ratio depending on the industry type, scale of business, concentration of customers and key suppliers and the risk profile of the business. Profit multiples used to value a business are falling in recent times illustrating that it is a buyers market when it comes to business sales.

Another option is to put a board in place prior to putting your business up for sale. A board can add value to your business and also make it more saleable and can present an opportunity for you to stay involved as a board member if the new owner so desires (and you too)!

So ensure you have your succession and exit strategy in place as a foundation for business success.

Ross – Virtual/Part-Time CFO