Where are you at?

Financial Year ¾’s done

As you would all be aware, we are now more than ¾’s through the current financial year. It is a busy time of year so I thought I would share my best practice timings for working on your business, rather than in it.

Best practice timings

In my view, best practice timings for working on your business are as follows:-

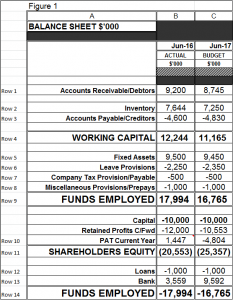

- Activity Based Costing (ABC) project covering the December quarter actual numbers to be undertaken. The work on this snap-shot costing and profitability exercise covering all products/services for the December quarter should be undertaken during the January/February/March period. The information derived from such an ABC project provides excellent profit insight and cost behaviour understandings and are your most powerful strategic tools. Being armed with such knowledge BEFORE your annual strategic planning process is invaluable. Knowing where you make and lose your money is the very most important step in formulating a strategy and should have been completed by now. Have you?

- Strategic Planning – Your off-site strategic planning workshop/think-tank should be undertaken during March with your management team. Identify and prioritise what your new strategic initiatives for the following 12months will be. This is done as a precursor to the preparation of the annual budget for the following financial year. This will ensure new strategies are incorporated into the budget thus creating accountability and ownership for executing such new strategies for the next financial year.

- Forecast full year 2017 9+3 – once your March financial numbers are completed, undertake your 9+3 forecast using 9 months of actual numbers to March and forecast the last 3months. The 9+3 forecast exercise is to be completed in April and comes up with a FY2017 full year forecast. This provides the best starting point for the baseline of your next financial year budget.

- Budget next financial year – combining your 9+3 forecast, strategic planning initiatives and other factors such inflation, growth etc. you will work on your budget for the next financial year during the May/June period ready for July 1st start of new fiancial year.

2nd Annual Manufacturing Survey

Our second annual manufacturing survey has closed and produced some interesting results. The personalised reports to survey respondents will be distributed shortly. Thanks to those folks for their participation.

Conclusion

So, those are my best practice timings of key business activities. Are you on schedule? Do you disagree with my approach?

Don’t hesitate to share your best practice views on timings with me.

Ross – Billson Advisory