Last week you completed your cost of sales budget, and hence determined a key metric: budget gross margin. A key take away from last week was the need to ensure you budget to make a gross margin that will cover your budget overheads and make a sufficient budget profit.

This week, we move onto the first of those budget overhead categories: Production and Distribution Overheads. Note the topic this week will not be relevant to service entities, but it is relevant to entities that are product focussed either as manufacturers and/or resellers/distributors.

PRODUCTION AND DISTRIBUTION OVERHEADS – EXISTING BUSINESSES

Distribution Overheads will apply to both manufacturers and distribution/reseller entities. Distribution Overheads include costs such as Warehouse Labour and Freight Outwards. Production Overheads will only apply to manufacturers and are the factory costs not already picked up in cost of sales (direct labour and variable overheads) and are relatively fixed. Major categories of Production Overhead costs include Production Supervision Labour, Stores Labour, Maintenance Labour, Repairs & Maintenance (R&M), Rent and Plant Depreciation.

The process and concepts that follow are equally applicable to both types of overhead costs and to all entities that incur any of these types of costs.

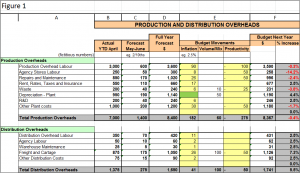

Your accounting system should already be reporting these costs as separate line items so this is your starting point for your current year forecast and then budget. A simple spreadsheet will be useful for preparing the forecast for the current financial year and budget for next financial year. Collect the year-to-date (YTD) actual costs by category. Let’s assume you have YTD actual costs for the 10months to April; refer Figure 1, Columns A and B below. Next you need to forecast the next 2months costs. A simple pro-rata using YTD Actuals can work if you have no other information to go on, refer Column C below. Adding these two numbers together gives you your current year full year forecast, refer Column D.

Next add another 3 columns to your spreadsheet and put in ‘inflation’, ‘volume/mix’ and ‘productivity’ columns representing movements from your forecast to your budget figures (refer Figure 1 column E). ‘Inflation’ would reflect known EBA or payroll rate increase from year-to-year and inflation projections. The ‘Volume/Mix’ column would be any volume variations that will affect costs. eg Waste, and other known variations such as depreciation increases through increased capital expenditure. The final column is the ‘productivity’ improvements you are budgeting for as reflected in your strategic plan.

Adding your current year forecast dollars to your ‘inflation’ increases, ‘volume/mix’ increases and ‘productivity’ savings (Figure 1, Column E) will give you a budget production overhead for next year, refer Figure 1, Column F below.

START-UP’s

If you are a start-up, hopefully your research will have identified the overhead resources you will need to run your factory and/or distribute your product. Put some values around the resources required to derive a simple budget for these costs for the next financial year.

SUMMARY

Use this week to develop your Production and Distribution Budgets (as applicable) and continue building the budget picture to provide a sound foundation for business success.

As always, if you need some help or guidance, don’t hesitate to call me on (03) 9554-3128.

Next week we continue with Overhead Budgets focussing on Selling and Administration Overheads.

Ross