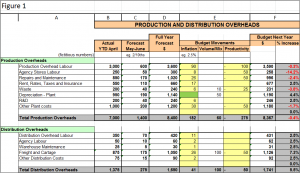

Last week you completed your first category of budget overhead expenses: Production and Distribution Overheads.

This week, we move onto the second and final category of budget overhead expenses: Selling and Administration Overheads. Every business needs to sell to survive and every business will have administration costs to incur. So this overhead category will apply to all entities whether they are manufacturers, distributors, service entities or start-ups.

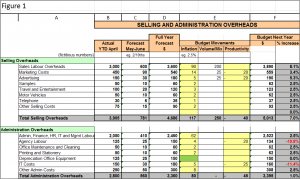

SELLING AND ADMINISTRATION OVERHEADS – EXISTING BUSINESSES

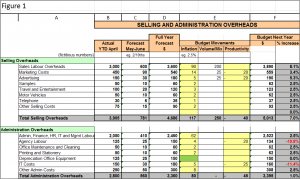

Selling Overheads include costs such as Sales and Customer Service personnel costs, Marketing costs, Mobile phones, Motor Vehicles, Travel and Entertainment, Advertising costs, Samples, Promotions and Website costs. Administration Overheads will include Accounting, Administration, IT and HR personnel costs, General management costs, IT Costs, Legal Fees, Stationery, Office Equipment depreciation etc. The process and concepts that follow are equally applicable to both types of overhead costs and to all entities that incur any of these types of costs. It basically mirrors the process you followed to develop your Production and Distribution Overheads previously.

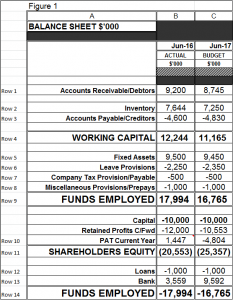

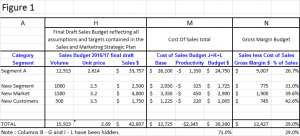

Your accounting system should already be reporting the actual costs as separate line items so this is your starting point for your current year forecast and then budget. A simple spreadsheet will again be useful for preparing the forecast for the current financial year and budget for next financial year. Collect the year-to-date (YTD) actual costs by category. Let’s assume you have YTD actual costs for the 10months to April, refer Figure 1, Columns A and B below. Next you need to forecast the next 2months costs. A simple pro-rata using YTD Actuals can work if you have no other information to go on, refer Column C below. Adding these two numbers together gives you your current year full year forecast, refer Column D.

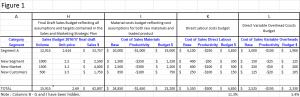

Next, add another 3 columns to your spreadsheet and put in ‘inflation’, ‘volume/mix’ and ‘productivity’ columns representing movements from your forecast to your budget figures (refer Figure 1 column E). ‘Inflation’ would reflect known EBA or payroll rate increases from year-to-year and inflation projections. The ‘Volume/Mix’ column would be any volume variations that will affect costs, eg product launch and marketing costs of new products, and other known variations such as depreciation increases through increased capital expenditure. The final column is the ‘productivity’ and cost saving initiatives you are budgeting for as reflected in your strategic plan.

Adding your current year forecast dollars to your ‘inflation’ increases, ‘volume/mix’ increases and ‘productivity’ savings (Figure 1, Column E) will give you a budget Selling and Administration Overhead budget for next year, refer Figure 1, Column F below.

As a point of reference, some companies have a target percentage-of-sales ratio they use to cover these Selling and Administration Overheads to ensure that these overheads stay in control.

START-UPs

If you are a start-up, hopefully your research will have identified the overhead resources you will need so you can sell your products/services and run your business. Put some values around the resources required to derive a simple budget for these costs for the next financial year.

SUMMARY

Use this week to develop your Selling and Administration Overhead Budgets and continue building the budget picture to provide a sound foundation for business success.

As always, if you need some help or guidance, don’t hesitate to call me on (03) 9554-3128.

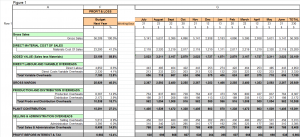

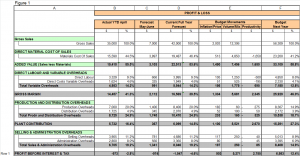

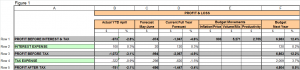

Next week we will pull together all the Profit and Loss forecast and budget data you have completed so far and add in some last pieces to come to your draft current year forecast and next year budget Profit and Loss statement.

Ross