I recently went to the Franchising Expo in Melbourne at the Exhibition Centre to listen to the latest developments in the industry. The sector is governed by the ACCC’s Franchising Code of Conduct.

As a bit of background, there are over 1,000 franchise networks in Australia employing almost half a million people so franchises are a significant part of the economy. Franchises are everywhere, ranging from the iconic McDonalds, the stable of “Jims” franchises through to more recent franchise models such as HR services for business.

Advantages and Disadvantages

Franchising is a 2-sided relationship with the franchisor entrusting their brand and reputation to you as the franchisee. Franchise fees range between $5k and $1miilion plus ongoing monthly fees.

The advantage of taking out a franchise is that you have access to a ready-made business brand, support, infrastructure, marketing, mentoring and systems so you are ‘not on your own’.

Whilst I acknowledge franchising is not for everyone, it certainly does increase your chance of business success with far fewer businesses failing than traditional owner-operator businesses in percentage terms.

I would suggest that before you consider whether Franchising is an option for you, reflect on your motivations and how you prefer operate as a business person.

If you think you are ‘buying’ a job or creating an ‘annuity’, I would suggest you think carefully as buying a franchise is a big commitment and investment and it has all the risks of business, so is not a guaranteed recipe for success nor is it a cruisy way to make a living.

Do you like structure and procedures or do you like to do your own thing? If you don’t like following set procedures and would rather be a genuine entrepreneur, then perhaps franchising is not for you.

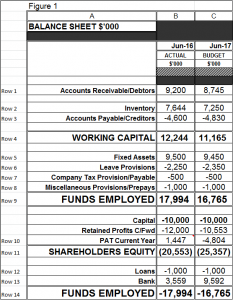

Figure 1 Hang on, who is this speaking…

Figure 1 Hang on, who is this speaking…

Franchising Due Diligence

One of the key obligations under the Franchising Code is the obligation of the franchisor to give prospective franchisees a disclosure document along with a copy of the franchise agreement. Please ensure you get a good lawyer to review these documents as they can be quite complex.

Before you commit to a franchise agreement, do your due diligence and ensure you talk to existing franchisees as a key part of the evaluation process. Do your numbers carefully, and as I keep saying in these blogs, make sure the 3 key strategic objectives of profit, cashflow and return on investment targets reflect the risk you are taking. Do a pre-purchase review with a good accountant and complete your business plan.

Don’t rush any decision to join a franchise. Ensure you treat this decision as you would any business investment decision and have a sound strategy in place as a foundation for your franchise business success!

Ross – Billson Advisory