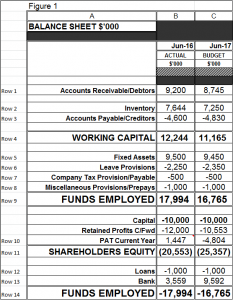

Last week, you completed a budget Balance Sheet for the next financial year.

This week, we will look at another key budget document: your budget Cashflow Statement. This is an important component of your budget because it will identify your budgeted cash movements and cash position. Knowing where you are going to be in terms of your money is critical so plans can be made to supplement cash if required, manage cash requirements and invest if surplus cash availability is your outcome.

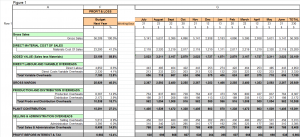

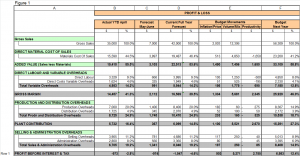

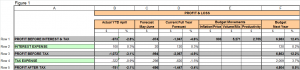

The beauty of creating a budget Cashflow Statement in excel is that when it is properly connected to your budget Profit & Loss (P&L) and budget Balance Sheet, the numbers for the budget cashflow statement should just automatically flow through.

Refer Figure 1 below as an example of a simple fictitious budget Cashflow Statement which is linked to the budget templates presented in previous newsletters. Column A represents broad categories of your Cashflow Statement and Column B is your budget cash movements for each of those categories.

Working through each of the key cash flow items in turn as follows:-

- Profit and Loss After Tax – refer Row 1 below – this amount is directly transferred from your budget P&L. Note this figure includes non-cash items such as depreciation. Depreciation of Fixed Assets (refer Row 2 below) needs to be added back from your budget P&L depreciation expense so as to determine Cash Inflow(Outflow) from Operation (refer Row 3 below).

- Inventory Movements – refer Row 4 below – this is the difference between your actual closing inventory balance from prior year and the budget inventory closing balance in your balance sheet. A positive number means you are reducing inventories which effectively impacts cash favourably.

- Receivables/Prepayments Movements – refer Row 5 below – as with the inventory above, this figure represents the difference between prior year actual closing balance and budget current year budget closing balance in your balance sheet. A positive number means you are reducing Receivables which effectively impacts cash favourably.

- Accounts Payable Movements – refer Row 6 below – this figure represents the difference between prior year actual closing balance and budget current year budget closing balance in your balance sheet. A positive number means you are increasing Payables which effectively impacts cash favourably.

- Non-Current Movements – refer Rows 8 and 9 below – as above, the figures represent the difference between prior year actual closing balance and budget current year budget closing balance in those balance sheet categories. A positive number means you are impacting cash favourably.

- Fixed Assets movements – refer Rows 11 to 14 below – the figures in this section represent budgeted cash movements in your Fixed Assets such as Capital Expenditure and/or Proceeds from Sale of Assets. A check on this number is done by subtracting budget depreciation expense from closing actual Fixed Assets written-down-value and comparing it to budget closing fixed assets.

- Shareholders Equity movements – refer Rows 15 and 16 below – this is usually zero but if owners are contributing more capital to the business, it needs to be factored into this section.

- Manual Adjustments – refer Row 17 below – I don’t like using this section as it is a ‘plug’ to make the Cashflow Statement balance. Only use it if there are small roundings.

- Net Cash Generated – refer Row 18 below – summing all of the above you get to a figure showing your net movement in cash. Make sure it makes sense. If it is a negative figure, do you need to revisit either your Balance Sheet or Profit and Loss statements? Do we need to curtail Capital Spending or more aggressively target customer collections?

- Cash Funding – refer Rows 19 to 22 – picking up opening and closing budget Bank/loan balances from your Balance Sheet, you will identify how you are budgeting to fund cash shortfalls or allocate cash surpluses. The total in Row 22 should equal the value shown in Row 18.

Do you need to organise funding in advance for your business to remain solvent or have you got surplus funds that can be invested to generate a return above bank interest?

If there is a seasonality factor to your business, you should look at doing a monthly phased budget Cashflow Statement so you can identify the peaks and troughs of your cashflow needs and plan ahead for any such requirements.

SUMMARY

Use this week to develop your budget Cashflow Statement and hence identify budget cashflow movements in and out of your business, sources of cashflow in your business and identify future Bank/Funding requirements as part of your budget process.

As always, if you need some help or guidance, don’t hesitate to call me on (03) 9554-3128.

Ross – Virtual CFO