This week is the final part of a 3-part topic focussed on developing a Cost of Sales Budget for the next financial year, and so determine your gross margins.

The definition of variable overheads in a cost of sales context for both products (Cost of Goods Sold) and services (Cost of Services) is the overhead that varies directly with the volume of production of the product or service. The variable overhead costs include things such as energy, consumables and factory supplies. Note that this week’s topic is not relevant to import/distribution/reseller entities that don’t produce goods or services.

MANUFACTURER/SERVICE PROVIDER – IF YOU HAVE MACHINE OR LABOUR ROUTINGS

As with last week, if you have a computer system, or excel spreadsheets that you use for machine and/or labour routings by product/service showing how many hours it takes to produce the product/service across the various production work centres, you can use the budget hours as determined in the direct labour hours exercise last week as your starting point. You can then use the actual current year-to-date (YTD) hours and volumes and actual direct variable overheads YTD and pro-rata these overheads for the machine or labour hour and volume movements between current year forecasts and next year’s budget. You then need to consider efficiency improvements or productivity savings you may have included as part of your strategic planning process and reflect those in your direct variable overhead budget also.

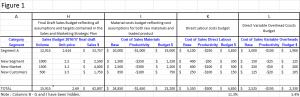

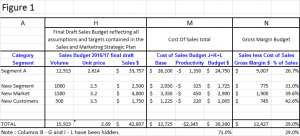

As with last week, you can then derive ‘budget overhead recovery rates’ for your work centres and ‘push’ them back into your machine/labour routes so as to build up budget variable overhead costs by product/service, refer Figure 1, column L.

MANUFACTURER/SERVICE PROVIDER – IF YOU DON’T HAVE MACHINE OR LABOUR ROUTINGS

If you don’t have machine or labour routings, you are best to look at using the actual current year-to-date (YTD) volumes and actual direct variable overheads YTD as a starting point and pro-rata these overheads for the volume variations between current year forecasts and budgeted volumes for next year. Factor in rate and inflation increases and also reflect any productivity initiatives you have identified in your strategic planning process that you expect to generate savings in variable overheads.

START-UP MANUFACTURER/SERVICE PROVIDER

If you are a start-up, hopefully your research will have identified the direct variable overhead resources you will need to deliver your product/services based on your budgeted volumes. Put some values around the resources required to produce your product/service for the financial year.

GROSS MARGIN

Sales less Direct Materials less Direct Labour less Direct Variable Overheads = GROSS MARGIN

Gross Margin is a key measure of business performance and you should be targeting a gross margin percentage (Gross Margin dollars divided by Sales dollars) that will cover your fixed overheads and make an profit at the appropriate levels; refer Figure 1, column M and N.

Use this week to develop the final component of your Cost of Sales budget, your Direct Variable Overheads Budget for the next financial year, and thus your Gross Margin, to provide a sound foundation for business success.

As always, if you need some help or guidance, don’t hesitate to call me on (03) 9554-3128.

Next week we move onto the Overhead Budgets starting with Production, Freight and Distribution Overheads.

Ross